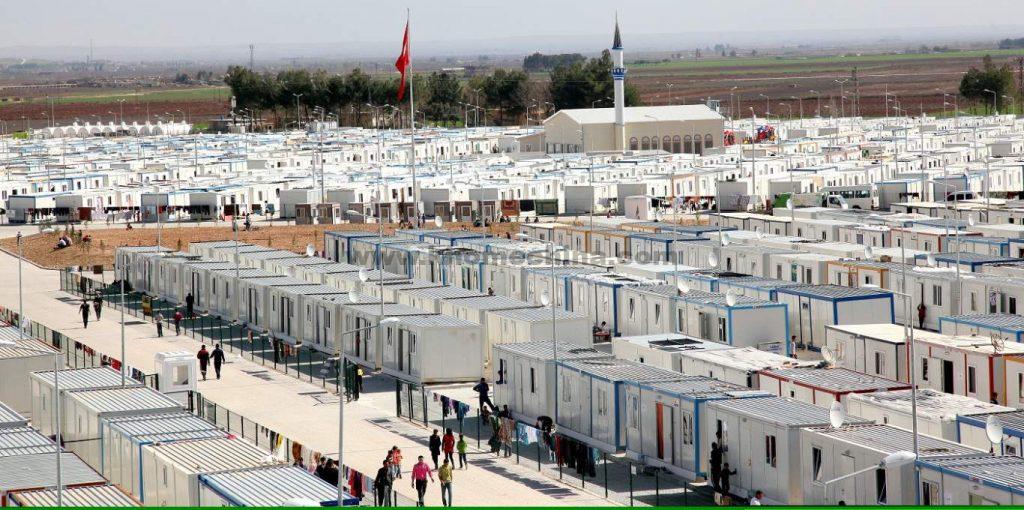

For overseas construction companies, developers, and investors, importing prefabricated houses (such as prefab container houses and modular buildings) from China can significantly reduce costs. However, tariffs are often a key factor affecting the final price. Fortunately, many countries offer tax-free or low-tariff policies for temporary buildings made in China, especially when imported through free trade agreements (FTAs) or special economic zones.

This guide will detail which countries can enjoy tax-free (low-tax) treatment when importing prefabricated houses from China, and provide practical strategies to optimize import costs to help you maximize profits.

List of countries with tariff-free/low-tariff import of prefabricated houses

We have listed the tariff treatment list of temporary buildings (container houses/prefabricated buildings) imported from China according to different trade agreements. This list is based on the latest effective agreement terms (2024 data):

ASEAN member countries (China-ASEAN Free Trade Agreement)

In accordance with the China-ASEAN Free Trade Agreement and the Regional Comprehensive Economic Partnership Agreement, the following ASEAN member states implement the agreed tariff rates on some products imported from China, gradually reducing tariffs to zero.

| COUNTRY | HS CODE | CONVENTIONAL TRIFF | TAX EXEMPTION CONDITIONS |

| Thailand | 9406900090 | 0% | Form E Certificate of Origin/RCEP Certificate of Origin |

| Vietnam | 9406900090 | 9% | RCEP Certificate of Origin |

| Malaysia | 9406900090 | 0% | Form E Certificate of Origin |

| Indonesia | 9406900090 | 0% | Form E Certificate of Origin |

| Philippines | 9406900090 | 0% | Form E Certificate of Origin/RCEP Certificate of Origin |

| Singapore | 9406900090 | 0% | Form E Certificate of Origin/RCEP Certificate of Origin |

| Myanmar | 9406900090 | 0% | RCEP Certificate of Origin |

| Cambodia | 9406900090 | 0% | Form E Certificate of Origin/RCEP Certificate of Origin |

| Laos | 9406900090 | 0% | Form E Certificate of Origin |

| Brunei | 9406900090 | 0% | Form E Certificate of Origin/RCEP Certificate of Origin |

TIP: All data provided by K-HOME are from the official customs websites of various countries/regions. The search results are for reference only and are not used on any legal basis.

Member countries of the Asia-Pacific Trade Agreement

The current member countries of the Asia-Pacific Trade Agreement include China, Bangladesh, India, Laos, South Korea, Sri Lanka, and Mongolia. These countries grant preferential tariff treatment to some products originating from China.

| COUNTRY | HS CODE | CONVENTIONAL TRIFF | TAX EXEMPTION CONDITIONS |

| India | 9406900090 | 9.3% | Form B Certificate of Origin |

| Sri Lanka | 9406900090 | 0% | Form B Certificate of Origin |

| South Korea | 9406900090 | 0% | Form B Certificate of Origin |

TIP: All data provided by K-HOME are from the official customs websites of various countries/regions. The search results are for reference only and are not used on any legal basis.

Other free trade agreement partners

- Asia: Pakistan, Maldives, Georgia, Mongolia.

- Europe: Switzerland, Iceland, Serbia.

- Latin America: Chile, Peru, Colombia, Ecuador, Nicaragua.

- Africa: South Africa, Mauritius.

- Oceania: Australia, New Zealand.

The free trade agreements signed between China and the above countries stipulate that the agreed tariff rates will be implemented on some products originating in China, and the tariffs will be gradually reduced according to the agreement arrangements to promote the development of bilateral trade.

| COUNTRY | HS CODE | CONVENTIONAL TRIFF | TAX EXEMPTION CONDITIONS |

| Chile | 9406900090 | 0% | Form F Certificate of Origin |

| New Zealand | 9406900090 | 0% | Form N Certificate of Origin/RCEP Certificate of Origin(3%) |

| Peru | 9406900090 | 0% | Form R Certificate of Origin |

| Costa Rica | 9406900090 | 0% | Form L Certificate of Origin |

TIP: All data provided by K-HOME are from the official customs websites of various countries/regions. The search results are for reference only and are not used on any legal basis.

The least developed countries to enjoy 0 tariff treatment from China in 2025

| CONTINENT | NUMBER OF COUNTRIES | LIST OF COUNTRIES |

| Africa | 33 | Angola, Benin, Burkina Faso, Burundi, Central Africa, Chad, Comoros, Democratic Republic of the Congo, Togo, Eritrea, Ethiopia, Gambia, Guinea, Guinea-Bissau, Lesotho, Liberia, Madagascar, Malawi, Mali, Mauritania, Mozambique, Niger, Rwanda, Djibouti, Senegal, Sierra Leone, Somalia, South Sudan, Sudan, Sao Tome and Principe, Tanzania, Uganda, Zambia |

| Asia | 8 | Myanmar, Laos, Nepal, East Timor, Afghanistan, Bangladesh, Yemen |

| Oceania | 2 | Kiribati, Solomon Islands |

TIP: All data provided by K-HOME are from the official customs websites of various countries/regions. The search results are for reference only and are not used on any legal basis.

How to verify the latest tariff rate?

1、Official channels (recommended for priority use)

You can check through the China Ministry of Commerce FTA Portal (which provides Chinese and English versions of the agreement text and tariff reduction schedule) and the official websites of customs of various countries

2、Key time nodes:

Most agreement tariff rate adjustments take effect on January 1 of each year; at the same time, on July 1 of each year, fiscal year tax rates of some countries change.

How to choose the optimal tariff rate?

● Step 1: Confirm the product HS code

● Step 2: Query the target country’s benchmark tariff

● Step 3: Verify the effective FTA between China and the country

● Step 4: Compare the tax rates under different agreements

For example:if you export container houses to Indonesia, the current agreed tariff rate when using RCEP is 11%, but when applying for Form E certificate of origin, the agreed tariff rate is 0%, so applying for Form E certificate of origin can exempt tariffs.

TIP:

1、This article is based on the trade agreement that will take effect in 2024. The actual tax rate may change due to factors such as product specifications and the applicability of trade agreements. Please refer to the final decision of the customs.

3、Last updated: April 2025 [K-HOME] It is recommended to make a second confirmation before the transaction.

Related Articles

Related Project

SEND A MESSAGE